One of the most challenging things you have to do when analysing systems is to really understand the customer’s point of view. We call it “obtaining Domain knowledge”. Ideally you want to see the world through the other person’s eyes so you can see the problems they are having and discover the best way to solve them.

And that often involves detecting blind spots where the customer simply cannot see the issue at hand, which then makes change management challenging - as you try to guide them to better ways of doing things. “Trust me, I’m a Systems Specialist” only gets you so far. Psychologists call this “Cognitive Dissonance” and it comes across as resistance to change.

It’s always fascinated me why those classically trained in economics struggle with the concepts in MMT and after a few exploratory discussions I think I may have a hypothesis on at least one of those difficulties.

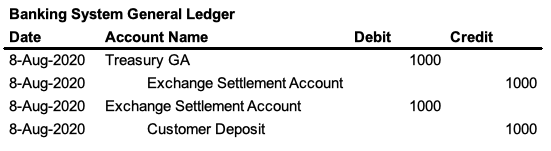

If a classically trained economist engages with accounting at all, they seem to do it using, what can best be described as, a General Ledger View, that seems to represent a consolidation of the entire banking system. They would appear to see a government furlough pay payment something like this.

All the debits and credits add up and the payment moves from the Treasury to the deposit holder as expected. It’s a transactional abstract overview of the process, and valid as far as it goes.

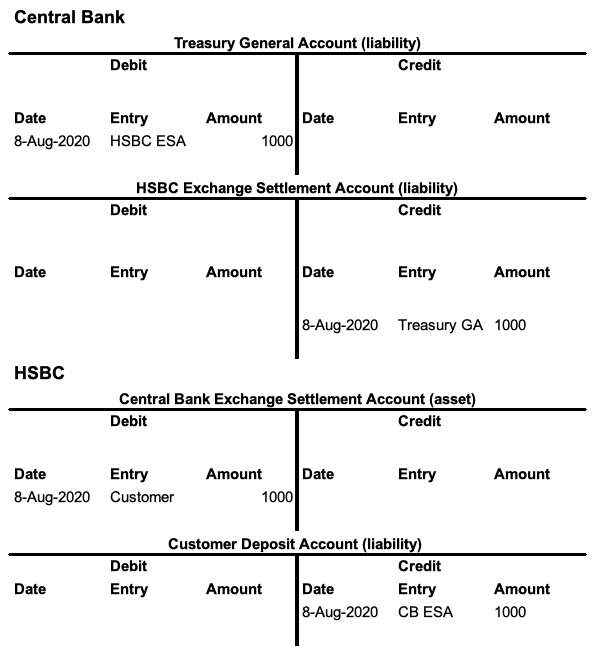

MMT, on the other hand, takes an institutional approach to its analysis and places the accounting within the institutional context. It also uses T-accounts rather than a general ledger which better sits with the balance sheet viewpoint it tends to take. Once you add the institutions and the balance sheet accounts to the transaction you get this view.

And this reveals what everybody in finance and banking understands. When government makes payments, banks get extra assets. And the banks play with those assets on the financial markets - including bidding for government bonds with them on their own behalf in addition to the customer bids using what is essentially the same amount of money.

Since you get two bids for the price of one, the government payment has clearly created something in the non-government sector that wasn’t there before.