As noted previously, investment bonds cannot raise any money for the central government. Neither can bonds raise any money for local authorities or devolved governments.

Why? Because such bonds would not be secure. Since local government lacks monetary sovereignty there is no guaranteed way to pay them back. To be secure, bonds have to be liabilities of the central funds at HM Treasury, not local government.

Therefore any money for local government comes from those central funds, which is just an extension to the usual Treasury Grant (or the local bonds are covered by an HM Treasury indemnity which amounts to the same thing). So why not just pay an adequate grant to local authorities in the first place and cut out the middleman?

An alternative would be for such bonds to be tradeable, at which point UK local authorities and devolved administrations would rapidly turn the UK into the Eurozone with the Bank of England becoming the entity buying up these ‘local authority bonds’ much as the ECB buys most of the southern European government bonds.

The intention, of course, is to bypass Westminster and the democratic control of the elected parliament, which is seen as getting in the way of the spending aspirations of certain political groupings.

This is the direction of travel of current monetary policy thinking - towards further abuse of the central bank’s purchasing capability. We are seeing that in the current shift away from purchasing government bonds, to purchasing corporate bonds. Before too long the central bank will be bailing out other private sector assets. It’s hardly surprising, then, that some wiley political types want to get in on the act by dreaming up other assets the central bank could ‘QE’ without having to obtain a vote in parliament first.

The MMT approach would have none of that and would halt the central bank’s purchasing of assets, and any further issuing of government bonds, locking the Base Rate at 0% permanently which would keep mortgages low forever.

MMT achieves this by introducing a Job Guarantee whose primary role is to replace interest rate targeting as the central mechanism by which the economic cycle is stabilised. In addition, it ends unemployment forever across the nation as a very valuable side effect of the stabilisation function. The spare labour is then granted to local authorities and groupings, and represents the only spare physical capacity there is to do any additional real work in the economy. Anything else requires taxation, not bond issues. Calling something ‘investment’ isn’t enough.

You can always tell when a critic has failed to understand MMT. They will hardly mention the Job Guarantee. Its central role of replacing the current anti-democratic machinations at the central bank will be completely missing. Instead, they will continue to support the current economic stabilisation mechanism - an unemployment buffer for the workers and the central bank propping up the cash flow of the rich. Largely, I suspect, because the latter includes them.

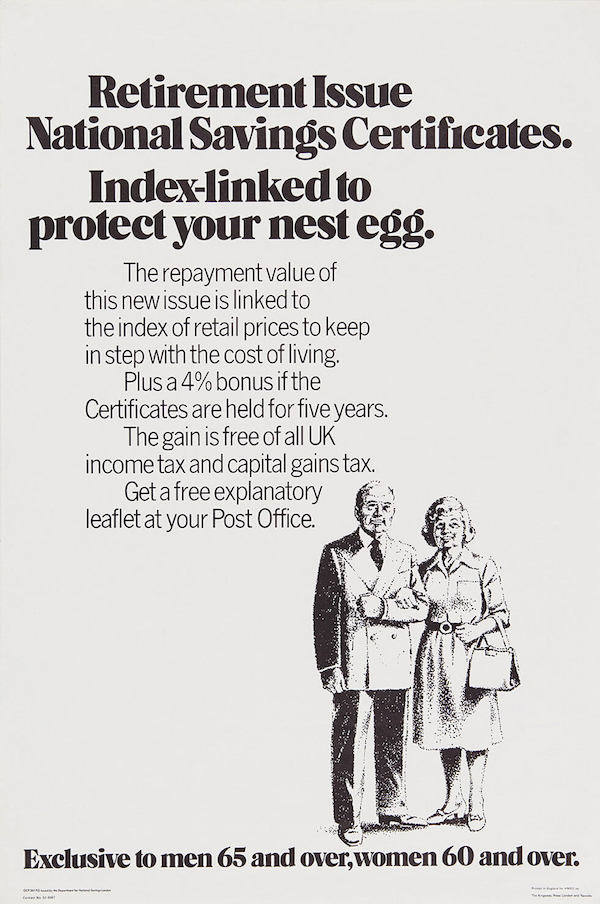

Why Granny Bonds?

There are a few people who argue that Gilts and Treasury Bills serve other purposes. These are the arguments for so-called ‘safe assets’. There is no justification for them, and the arguments don’t stand up to scrutiny when analysed systemically and from an MMT viewpoint.

Government bonds are nothing more than tradeable welfare payments, and welfare payments should be democratically targeted not market purchasable.

The reason we don’t need them in the UK, whereas there may be arguments in other nations, is because we have National Savings and insured deposits. The corrective institutions already exist and are operational.

Although the UK government has no need for Sterling from anybody, there are entities within the economy that need to save very safely. Who are these people who require a safe savings mechanism and, if there are any with merit, how do we provide that?

Once you go through the list, you find that only individuals have a justifiable need for safe savings back by the government - if the society considers that saving for retirement is the way to deal with the pension provision issue. (Central government can, and does, provide a flat state pension for everybody via the taxation mechanism). Here in the UK, we have a long history of saving for retirement and the differential pension provision between individuals that implies. It is unlikely that UK citizens will want to give that up.

The problem is that pension funds cannot provide that pension by private means alone, to the extent that the government invented Index-Linked Gilts as a way for pension funds to cover their liabilities via, essentially, a backdoor into the taxation mechanism. However, due to ever-lower interest rates, and increased demand, those are no longer sufficient.

For example, the ”0 1/8% Index-linked Treasury Gilt 2051” was issued on the 9th Feb 2021 at an issue price of 189.70 per 100. In English, that means you get 12.5p for every £189.70 you use to buy the bond. To get a modest top-up index-linked pension of £10,000 per annum using those would require a capital investment of some £15,176,000. That’s not the sort of sum you’d be able to save up on your average road mender’s salary.

Index-linked gilts maintain the value of capital as well as income. However, at the issue prices they are selling for today, that isn’t sufficient to retain the capital sum over time. In the example above over £7 million of present value disappears as soon as you drive the bonds out of the auction room, which is even worse depreciation than buying a Jaguar.

We are likely to need National Savings annuities, where an individual can build up an annual additional pension by purchasing ‘Granny Bonds’ directly. They would have limited residual capital value and no capital uplift, but they would give a secure additional income in retirement for ordinary people who decide to be thrifty and save. The precise level and nature of the instruments is open to debate.

Anything Further?

Beyond that, deposit insurance in banks would cover rainy day funds. The current value is £85K. Unlimited deposit insurance for individuals (directly and on trust - to cover client accounts at solicitors, for example) would be as much as is required.

As for everybody else, the market will provide. For corporates, the default option for their cash pile deposit is an involuntary investment in a bank. Society doesn’t want them to have a cash pile, it wants them to run their working capital on an overdraft.

For smaller operations and service businesses without the sort of ‘hard asset’ collateral banks require, the government could provide £50K of overdraft insurance to the banks, much as they are doing at present with the Business Interruption Loans.

Foreign holders of Sterling hold that money for neo-mercantile purposes due to a belief in ‘export-led growth’. They need to spend it, invest it properly, or be left, once again, with the default investment of a Sterling deposit in a bank. There is no reason why the UK taxpayer should be propping up capital values in the Norwegian Global Pension Fund (or any other foreign pension fund or central bank) with public interest payments.

A reduction in bonds means an increase in cash and reserves, and therefore less need for repos and other collateralised transactions. Instead, go back to using real things as the basis for collateral and discount them into money, which is what banks are supposed to do for a living.

If banks have got so soft that they can’t price properly off zero, then it’s time to let the market sort them out and produce banks that can price off zero properly. If that means a few banks have to go to the wall, so be it. You wanted capitalism - that’s how it works.

Once we no longer need banks as the channel for economic stabilisation, we can allow the banks to be subject to full market competition, which will drive the improvements that are desperately needed in that area.

The MMT view

MMT understands that a permanent 0% policy rate is the base case for analysis of a floating exchange rate currency, since that is the natural rate of interest in such a system. It concludes that it is better to pay government money out to people as wages, than banks as interest.

The MMT analysis shows that will lead to an economy running at a higher real output than it is capable of doing under the current regime of targeting inflation with discretionary interest rate adjustments.

It turns out that discretionary monetary policy has the same systemic flaws as discretionary fiscal policy. It’s still pro-cyclical because it has humans in it.

Being unelected doesn’t stop them from getting it wrong. It just stops them being held to account by those who suffer at their hands, as those on the persistent involuntary unemployment buffer can attest.