I stumbled across an interesting post today from a few years ago discussing Sovereign Russian Eurobonds. Eurobonds are bonds that are issued in denominations other than Roubles, rather than just the ones denominated in Euros. (Yes it is confusing). Russian Eurobonds really came into their own after the rounds of sanctions from 2014 onwards prevented investors investing in Russian rouble denominated bonds. However the underying reason for issuing them is more interesting.

The real reason Russia is selling more debt, and buying up old eurobonds and that its new bonds contain something pretty novel to the world of sovereign debt, “alternative payment currency event” triggers.

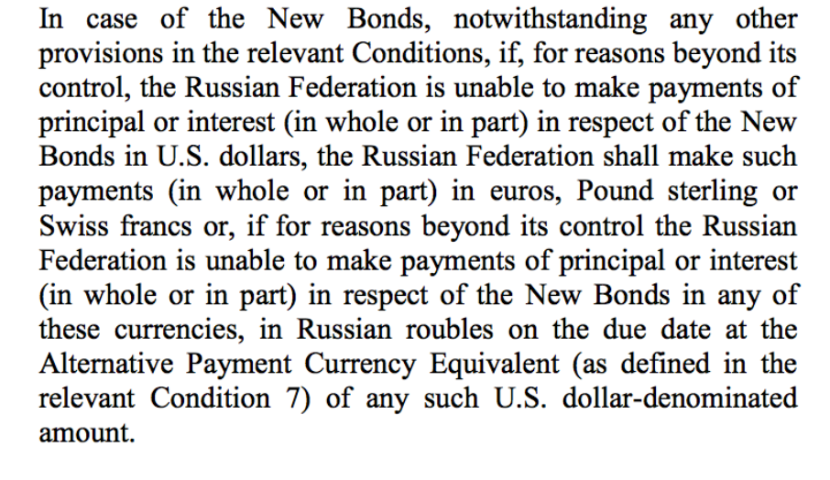

Since 2018 Russian Eurobonds have had the following terms in their bond contracts.

What that means is that Russia has the legal right to pay coupons and redemptions in Roubles to investors on bonds issued after 2018. There can’t even be a technical default on these.

For those where there could be a technical default, the envisaged process is farcical. It goes roughly like this:

Russia issues an instruction to pay to its correspondent bank in the US. The correspondent bank refuses the request to comply with sanctions. The bond holder declares a default and claims on their insurance. The insurance company, after paying out and marking up premiums elsewhere to compensate, then goes to court and has the Russian assets seized - which will be the bank deposit Russia was going to pay the bond holder with anyway.

A nice little earner for corporate lawyers and insurance firms.

If I have to pay to watch a farce I’d rather book a show in the West End and watch a good one.