Much has been written about the Russian demand that Europe pays for its gas in Russian Roubles. Most of it is ill-informed and even the good stuff slightly misses the point.

What they miss is that in every single international transaction the consumer pays with the currency they have, and the producer gets the currency they want to hold. It is the job of the finance industry to make the match magic happen, for which they get handsomely rewarded.

What that means is Gazprom already gets paid in Roubles for the part of its operation that is based in Russia. How could it pay Russian staff otherwise?

Therefore, all that is likely to change once the edict from Putin is in place is that Gazprom will tend not to hold Euros, assuming it is doing so at the moment anyway. Given the confiscations of Russian assets going on I’d be amazed if the treasury department in Gazprom hasn’t already dumped any asset denominated in Western currencies. Arguably they’d be negligent if that hasn’t happened.

Banks transact internationally by finding a path of banking relationships around the world between the buyer and the seller. This process of hopping the transaction around is called correspondent banking and works very much like the routers on the Internet that move traffic around. It may look like you have a point to point connection with this blog site but in reality the page you are viewing has passed through maybe a dozen router’s hands before it gets to you. International bank transfers work in much the same way. Each bank pays the next down the chain until it gets where it needs to go. If the direct path is blocked, the payment will be routed elsewhere in the world until a path is found. Banks in ‘non-hostile’ countries stand to make a packet.

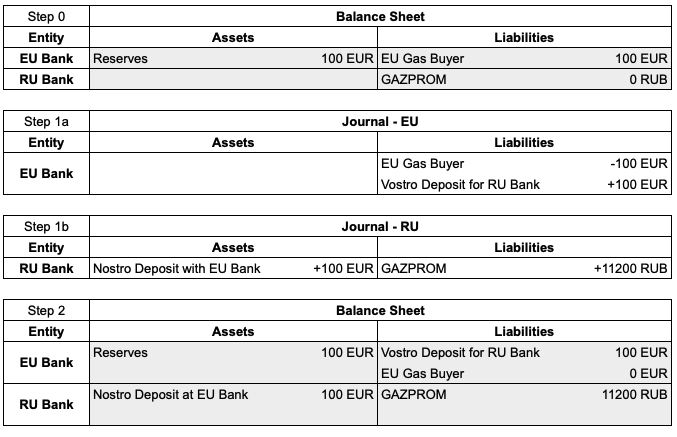

In all likelihood the normal situation was probably something like this:

Here the EU Gas Buyer pays Gazprom for their gas using Euros. The bank takes the payment and transfers it to the Russian bank account of Gazprom. Gazprom gets credited at the Rouble exchange rate quoted by the Russian bank and the Russian bank takes an FX position in Euros with the source EU bank.

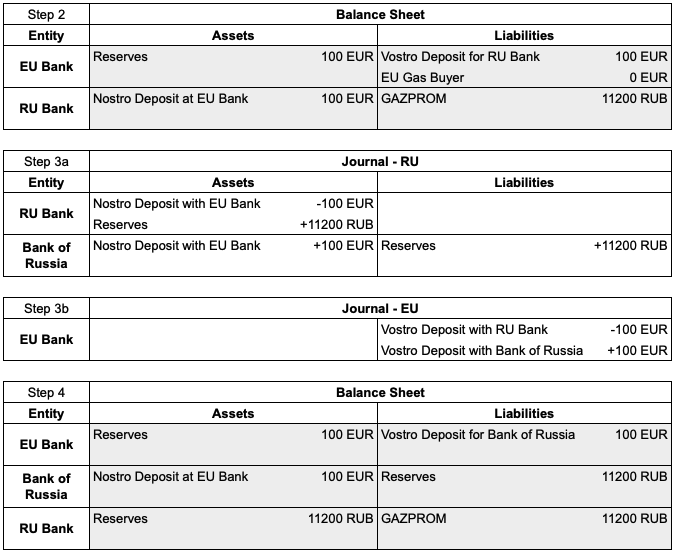

Now banks are notoriously risk averse in payments and the Russian bank will want to get rid of the Euro position as soon as it can. Up to now that has been rectified by the Bank of Russia taking the Euros and holding them itself - unusually with EU Banks rather than directly at the ECB.

Here the Bank of Russia takes the Nostro Euro deposit from the Russian Bank, with the EU Bank making an internal transfer in the Vostro mirror accounts to match. In return the Bank of Russia credits the Russian Bank with Rouble Reserves. (Probably the Bank of Russia will then Reverse Repo the deposit for a higher paying EUR financial asset).

What this shows is that the Russian government’s demand that everything is paid in Roubles doesn’t actually alter anything because Gazprom is being paid in Roubles anyway. The gas buyer will still be paying with Euros, with the banks in between earning a fat fee for shuffling the paperwork.

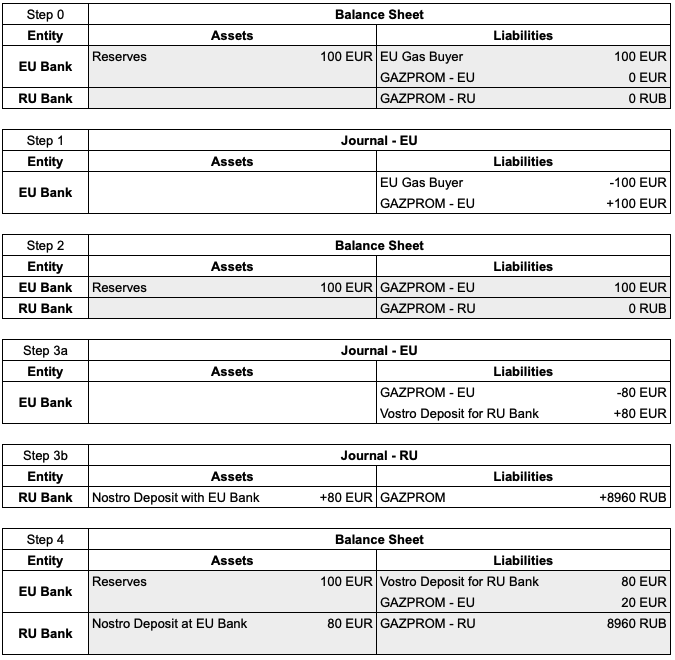

Now it may be that Gazprom wasn’t having all of its Euro income transferred to Russia. The current edicts only require 80% to be transferred to Russian banks, which looks something like this:

Here Gazprom first receives the Euros into its own account at an EU bank and then transfers some of that into Roubles in its Russian account. It may be that the new edict is a way of forcing Gazprom to stop holding Euros, while also creating political confusion amongst the majority of people who have no clue how international banking transactions are settled.

Having read this far have you spotted the issue that may just cause some fun? Remember that banks are very risk averse and don’t want to hold open positions in foreign currencies. If the Bank of Russia no longer offers to take Euros from Russian commercial banks, or no longer can due to sanctions, then the exchange rate offered by the Russian banks will be the one that allows it to get rid of its Euro position. In other words it has to be matched by a Rouble to Euro purchase going in the other direction. Except that sanctions mean little is currently going in that direction.

That’s a recipe for a very large appreciation in the value of the Rouble, or a full blown EUR-RUB liquidity crisis where Roubles can’t be obtained at any price. This may be another reason why Russia is demanding that future gas contracts will have to be not just settled in Roubles but priced in them in the first place. Shifting the exchange rate risk to the Europeans makes sense - because they are convinced that sanctions are going to make the Russian currency depreciate.

Chat about this and any other MMT topics with the growing New Wayland community