The title of this blog is a riff on the famous 1968 letter to the editor by the late Edsger W. Dijkstra called ‘Goto Statements Considered Harmful’. It started a debate within computer science that lead to eliminatation of ‘spaghetti code’ (funnily enough often written in FORTRAN) and the long slow road to using advanced ‘high level’ techniques. It led to the proof that goto statements were never required in programs, and the extensive mathematical work to provide the basis of higher level tools and techniques that I use every day in my work as a systems consultant.

The paper contains the following quote:

… our intellectual powers are rather gathered to master static relations and that our powers to visualize processes evolving in time are relatively poorly developed. For that reason we should do (as wise programmers aware of our limitations) our utmost best to shorten the conceptual gap between the static program and the dynamic process, to make the correspondence between the program (spread out in text space) and the process (spread out in time) as trivial as possible

The parallel with economists and the economy should be clear to anyone observing their intellectual approach to the subject.

And secondly the letter sparked a whole series of papers and articles entitled ‘X considered harmful’ for a whole plethora of X. I am proud to continue the tradition and introduce the seminal work of Dijkstra and his colleagues to a wider audience.

What are Gilts?

Gilts are HM Treasury securities, like the Treasury securities of the USA. They represent liabilities of the National Loans Fund and are issued by the state.

Functionally they are a form of guaranteed income bond - like the savings certificates issued by National Savings. In fact, in the not too distant past, you could purchase Gilts via National Savings as an alternative to the products National Savings issued itself.

But there is one key difference. National Savings Income Bonds can only be bought by individuals, there is a fixed holding limit and they are non-negotiable (i.e. they can’t be transferred - only sold back to National Savings or held until maturity), whereas Gilts can be held be any entity national or international, in any quantity and traded in a marketplace. A marketplace that has an unreasonable and unnecessary influence on national politics.

Once you understand that Gilts, like Savings Bonds, attract regular income and are a government annuity paid by the state to the holder of the Gilt, then you have to start assessing it like any other recipient of a government benefits - tax credits, state pension, disability benefit, housing benefit.

In other words what is the public purpose of providing the Gilt holder with a state income?

Who holds Gilts?

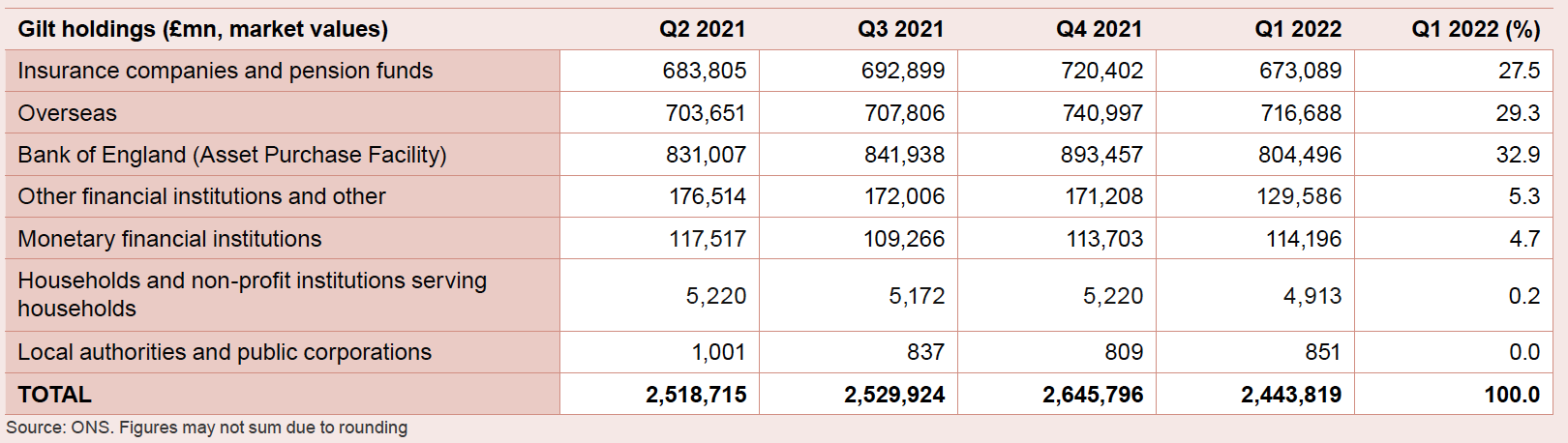

The Debt Management Office, a department of HM Treasury, issues Gilts and the produce a quarterly review of the Gilt Market. The holding distribution is as follows:

As you can see from the distribution, even excluding the nominal holding by the Bank of England, very few Gilts are held directly by Households. The vast majority is held by financial intermediaries and overseas entities.

What is the public purpose of having these middlemen in the process? What is the public purpose of paying a state income to overseas entities? What is the public purpose of the trading market?

Gilts suppress Asset prices

Because Gilts pay an income and are negotiable, they add to the total income available to the private sector.

When the Bank of England withdrew Gilts from the market via QE, leaving in place the alternative Bank Reserves, the price of other assets went up.

When Gilts are issued other private assets fall to a lower price than they otherwise would be. This is because more income is paid on Gilts than on the alternative bank reserves,

That may sound like a great idea, but high prices attract competition and more production of assets, which then lowers prices by providing greater supply. And we need a greater supply of assets - particularly housing.

If the private sector won’t produce assets to bring prices down, then government should step in, remove production resources from the private sector, and produce the assets itself, not force down asset prices by paying sinecures to financiers.

Can we really justify enriching the finance industry, while suppressing cost of living increases in Universal Credit and State Pensions?

Gilts are just liabilities of the State.

Asset Purchases (QE) swap Gilts for Bank Reserves, to very little effect in the real economy. As it notes in the Whole of Government Accounts1

Consolidating Quantitative Easing does not significantly reduce the overall liabilities of government but it does reduce the number reported as government borrowing. Once intra-government transactions are eliminated, the scheme represents an exchange of gilts (liabilities of the National Loans Fund) for central bank reserves (liabilities of the Bank of England).

Why pay a higher interest rate, or a term premium when you don’t need to?

Gilts back Private Pensions

The main contention made to support Gilts is that they manage the risk profile of private pension firms. And it is true that they do. In fact Indexed-Linked Gilts were introduced in 1981 by the Thatcher government specifically to do just that. The rationale behind them is a triumph of monetarism.

This tells us that the private pension industry is incapable of managing the risk profile of pensions solely within the private sector. It requires permanent government assistance to do so, as we saw in October 2022 when the Bank of England was forced to intervene in the Gilt Market to prop up Pension Funds that had been inapprpriately dabbling in interest rate swaps. What is the purpose of the private pension industry if it can’t deliver the outcome that is required?

A simple pension payment plan at National Savings, along the lines of the Guaranteed Income Bonds and Indexed Linked Savings Certificates, would solve the problem permanently, would be limited to individuals, and would allow them to manage their risk profile as they approach retirement. (Rather than an annuity or ‘drawdown’, they would sell out of risky assets and transfer the money to National Savings, or just save for their pension directly in National Savings from the start).

Since it would be only available to individuals and there is no need to pay middlemen, it is clearly far more efficient than the current Gilt issuing system.

Gilt Issues Considered Harmful

I agree with the conclusions reached by Bill Mitchell and Warren Mosler. Read Bill’s post on public debt for a more detailed critique.

Most of the arguments made in favour of sustaining public debt issuance can be reduced to special pleading by an industry sector for public assistance in the form of risk-free government bonds for investors as well as opportunities for trading profits, commissions, management fees, and consulting service and research fees. […]

The operation of public debt markets absorb a diversity of real resources deployable elsewhere. […] The opportunity costs in terms of the labour employed directly and indirectly in the public debt ‘industry’ are both real and large.

The ‘cottage industry firms’ that characterise the public debt industry use resources for public debt issuance, trading, financial engineering, sales, management, systems technology, accounting, legal, and other related support functions.

These activities engage some of the brightest graduates from our educational system and the high salaries on offer lure them away from other areas such as scientific and social research, medicine, and engineering.

On balance, public debt markets appear to serve minor functions at best and the interest rate support can be achieved simply via the central bank maintaining current support rate policy without negative financial consequences.

The public debt markets add less value to national prosperity than their opportunity costs. A proper cost-benefit analysis would conclude that the market should be terminated.

This is an updated version of a blog first published in Sept 2015

Chat about this and any other MMT topics on Discord with the growing New Wayland community . New members can click this invite link which will add the server to your Discord account

Whole of Government Accounts 2011, §7.54, p65 ↩︎